Solution Manual for Financial Analysis with Microsoft Excel, 6th Edition

$35.00 Original price was: $35.00.$26.50Current price is: $26.50.

Solution Manual for Financial Analysis with Microsoft Excel, 6th Edition

This is completed downloadable of Solution Manual for Financial Analysis with Microsoft Excel, 6th Edition

Product Details:

- ISBN-10 : 1111826242

- ISBN-13 : 978-1111826246

- Author: Timothy R. Mayes, Todd M. Shank

Now readers can master their Excel 2010 skills while establishing a strong understanding of contemporary corporate finance. Mayes/Shank’s FINANCIAL ANALYSIS WITH MICROSOFT EXCEL 2010, 6E shows today’s reader how to tap into some of Excel 2010’s most powerful tools to solve real financial problems. The book’s solid content addresses today’s most important corporate finance topics, including financial statements, budgets, the Market Security Line, pro forma statements, cost of capital, equities, and debt. This edition now covers Excel tables, pivot tables and pivot charts and other areas that have become increasingly important to today’s employers. The book’s reader-friendly, self-directed learning approach and numerous study tools help readers build upon basic skills for the Excel 2010 proficiency and the solid finance knowledge business professionals need for success.

Table of Content:

Capital budgeting techniques helps to take decision as whether a project should be accepted or rejected by the firm. There are many capital budgeting techniques like Net Present Value, Internal Rate of return, Profitability Index and many more.

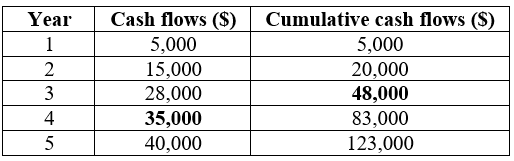

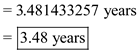

The Initial cost for Project A and B is $75,000 and projected cash flows for both the projects for five years is given.

(a)

The Weighted Average Cost of Capital (WACC) is 10%.

Calculate the payback period for Project A as follows:

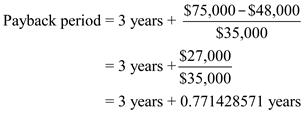

The initial outlay of the project is $75,000. This will be recovered in year 3 plus fractions of fourth year. Payback period is as follows:

Therefore, the payback period for Project A is  .

.

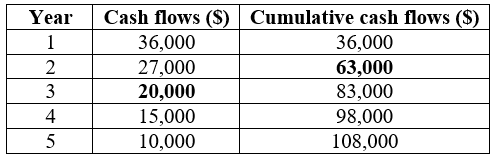

Calculate the payback period for Project B as follows:

The initial outlay of the project is $75,000. This will be recovered in year 2 plus fractions of third year. Payback period is as follows:

Therefore, the payback period for Project B is  .

.

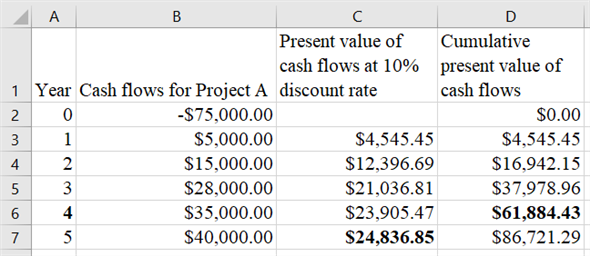

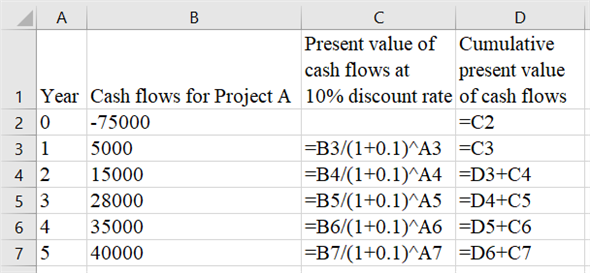

Calculate the discounted payback period for Project A as follows:

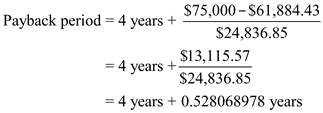

The initial outlay of the project is $75,000. This will be recovered in year 4 plus fractions of fifth year. Payback period is as follows:

Therefore, the discounted payback period for Project A is .

.

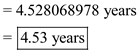

Calculate the discounted payback period for Project B as follows:

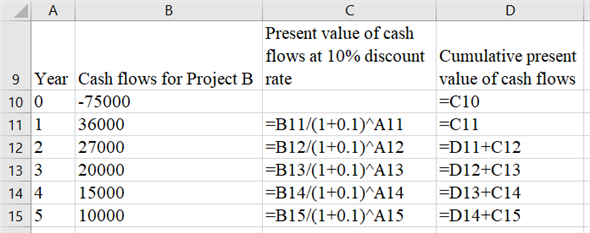

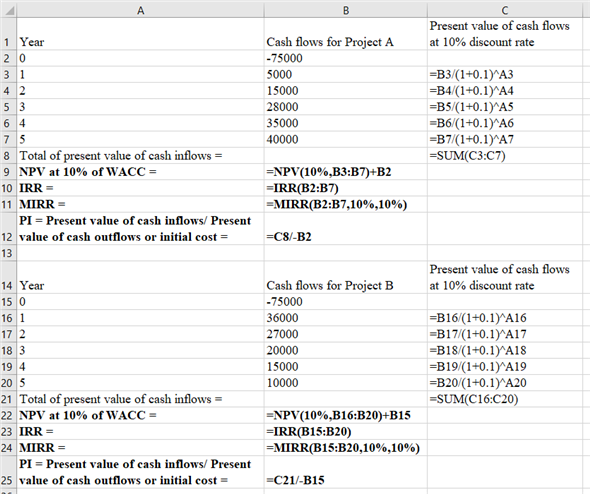

Formulas for above values are as follows:

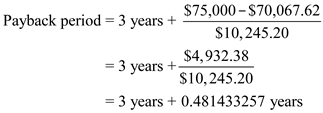

The initial outlay of the project is $75,000. This will be recovered in year 3 plus fractions of fourth year. Payback period is as follows:

Therefore, the discounted payback period for Project B is .

.

Formulas for above value are as follows:

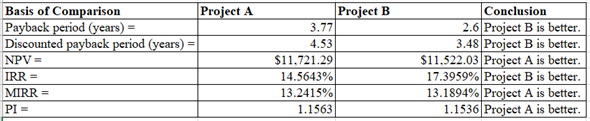

Conclusion:

Generally, the project is selected based on NPV. So, in this case Project A should be selected as it has higher NPV.

(b)

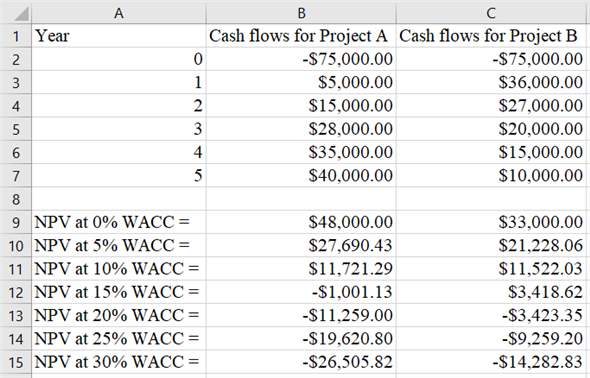

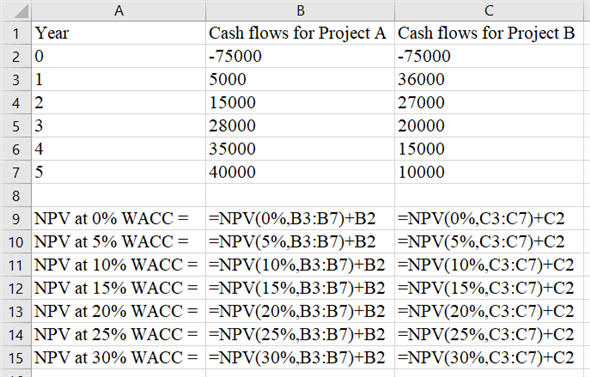

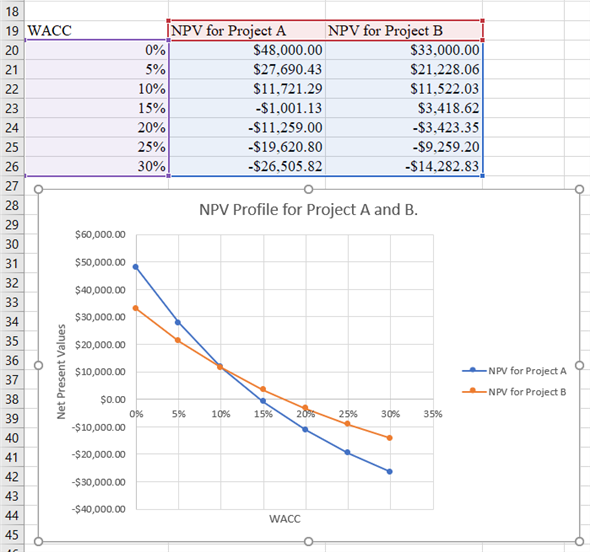

Create NPV Profile for Project A and B at various WACC as follows:

Chart for NPV Profile for Project A and B is as follows:

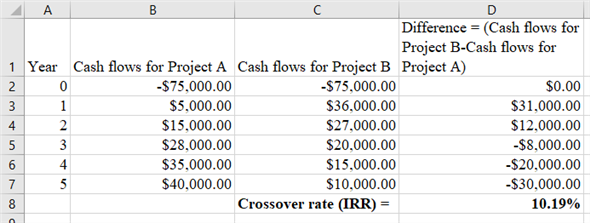

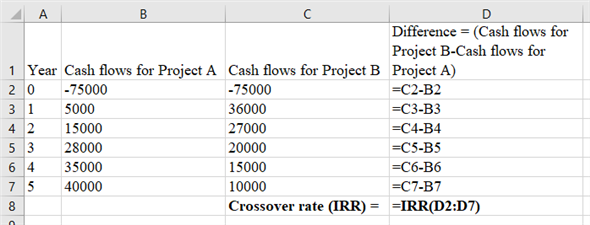

Calculate the exact cross over rate as follows:

Formulas for above values are as follows:

Therefore, the exact crossover rate for these two projects is  .

.

People Also Search:

financial analysis with microsoft excel

financial analysis with microsoft excel 6th edition

financial analysis with microsoft excel 6th edition download scribd

financial analysis with microsoft excel 6th edition solution manual download pdf

Related products

Solution Manual

International Accounting Doupnik 4th Edition Solutions Manual

Solution Manual

Solution Manual

Auditing A Risk Based-Approach to Conducting a Quality Audit Johnstone 10th Edition Solutions Manual

Solution Manual

Management Information Systems Managing the Digital Firm Laudon 14th Edition Solutions Manual

Solution Manual

Solution Manual

Solution Manual for Introduction to Robotics Mechanics and Control 3rd Edition by Craig

Solution Manual

Solution Manual for Introduction to Electrodynamics, 4/E 4th